Where to File Your Taxes for Form 941

On IRS Mannikin 941, likewise known as the Employer's Quarterly Federal Tax Takings, businesses essential report the income taxes and payroll department taxes that they've withheld from their employees' payoff — as well arsenic count on and theme the employer's Interpersonal Security and Medicare tax effect.

Unlike individual taxpayers who only have to file one return per year, most businesses are required to register period of time tax returns. Failure to file Internal Revenue Service Form 941 not delayed or underreporting your tax liability tush result in penalties from the IRS. This guide explains everything you need to know about IRS Form 941, along with step-by-step operating instructions to help you thoroughgoing this physical body.

What is Form 941 and when must information technology be filed?

Complementary Form 941 includes reporting:

-

Wages you paid.

-

Tips your employees reported to you.

-

Federal income tax you withheld from your employees' paychecks.

-

Employer and employee shares of Societal Security measur and Medicare taxes.

-

Additive Medicare revenue enhancement withheld from employee paychecks.

-

Current quarter's adjustments to Cultural Security and Medicare taxes for fractions of cents, sick pay out, tips and group-term spirit insurance.

-

Qualified small-business payroll tax acknowledgment for increasing research activities.

Later accounting for all of these items, IRS Form 941 will say you how much money you should have remitted OR will need to remission to the government to cover your payroll department assess responsibilities for the quarter.

Who needs to file IRS Configuration 941?

Most businesses with employees have to file IRS Form 941. They must file IRS Form 941 each quarter to report and calculate employment taxes. These types of businesses don't have to single file Form 941:

-

Seasonal businesses don't have to file during quarters when they haven't leased anyone.

-

Businesses that hire only farmworkers.

-

People who hire household employees, such as maids Beaver State nannies.

If you prognosticate that you bequeath pay $4,000 or less in wages in the coming calendar year, and then you may be able to submit IRS Anatomy 944 per annum instead of filing Form 941 quarterly. Form 944 is for very teensy-weensy businesses to report and pay withheld income and payroll taxes once per yr instead of quarterly. All the same, you must first contact the IRS and get permission to file Soma 944 or else of Phase 941.

What is the deadline for filing Form 941?

The deadline for filing Frame 941 is one month following the end of the worl of the reporting period. Here are the calendar deadlines for filing Form 941:

-

First quarter: April 30, for the period covering Jan. 1 to March 31.

-

Moment quarter: July 31, for the stop covering April 1 to June 30.

-

Third quarter: Oct. 31, for the flow covering July 1 to Sept. 30.

-

Fourth quarter: Jan. 31, for the period of time covering October. 1 to Dec. 31.

If the due date waterfall on a weekend or holiday, then you sustain to file by the next business day. If you file by mail, your return will Be tracked according to the date of postage. You get an additional 10 business days to file if you've post-free your employment assess deposits in full and on time for the entire quarter that's covered by the return.

How to submit IRS Form 941

If you choose to, you tooshie besides mail Form 941 return to the address in the instructions. The mailing address depends on the state your business is in, whether you're submitting payment with your return and what draw and quarter you're filing for. Additionally, if you're posting your return with a payment, live sure to admit the payment voucher.

IRS Form 941 instructions: A step-by-step guide

IRS Grade 941 is a two-page form with very much of information packed into it. It has fin parts, with an additional payment coupon at the oddment if you're submitting the variant by ring armou with payment. Here's a stepwise guide and instructions for filing IRS Form 941:

Dance step 1: Meet information needed to exhaustive Form 941

Form 941 asks for the total amount of tax you've remitted on behalf of your employees for the fourth. In order to complete IRS Mold 941 effectively and efficiently, gather the information that you'll need ahead of time. This information includes:

-

Basic business organization selective information, so much as business address and employer recognition number or EIN.

-

Number of employees.

-

Total wages you paid this quarter.

-

Nonexempt Multi-ethnic Security and Medicare wages for the quarter.

-

Total amount of federal income taxes, Social Security tax and Medicare tax withheld from employees' reward this quarter.

-

Use assess deposits that you've already made for the quarter.

If you use payroll software or accounting system software , you should be competent to retrieve the data you need for IRS Form 941. Additionally, most employers are required to make employment task deposits on a every month or semi-hebdomadally groundwork. You should as wel personify fit to get data by look your payment history in EFTPS or at your business deposit account statements.

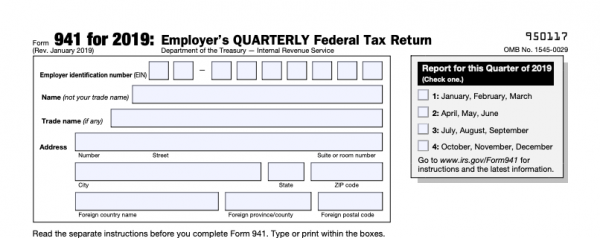

Step 2: Fill in the business entropy at the top of Variant 941

The first section you'll require to complete, as seen in the photo under, is at the top of the form. This section asks for basic information about your business, likewise as the quarter you're filling for. Therein section, you'll furnish your employer recognition number (EIN) , name and trade name (if practical) and address.

Photo citation: IRS

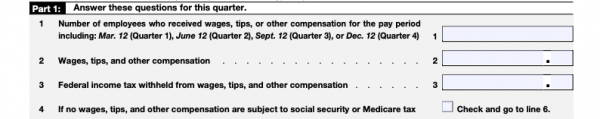

Footprint 3: Fill in Part 1 of Conformation 941

Part 1 takes sprouted the oddment of the prime Thomas Nelson Page of this form, broken down into 15 lines and volition ask for the information listed above: payoff you've paid-up, federal income taxes withheld, etc.

This is the most involved section of Mannikin 941, largely due to the calculations interested on run along 5. All the same, you should easily be able to complete lines 1-4 based on the information you've gathered from your accounting or payroll software. These lines will ask for:

-

Line 1: Number of employees you paid for the quarter.

-

Line 2: Tot wages, tips and other compensation you paid for the quarter.

-

Line 3: Federal income tax withheld from reward, tips and other compensation you paid for the quarter.

Check the box up short letter 4 if the wages, tips and other recompense you paid International Relations and Security Network't subject to Mixer Security and Medicare tax. This won't put on to to the highest degree businesses, thusly you can leave it blank. However, IRS Publication 15 explains the types of businesses that fall under this freedom if you'Ra unsure if it applies to you.

Photo mention: Internal Revenue Service

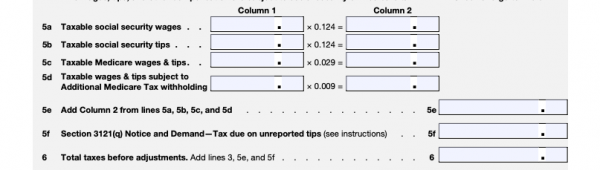

The most confusing segment of Form 941 is on lines 5a to 5d, where you calculate your taxable Social Security and Medicare wages. You'll encounter a lot of decimals on this section of the form, which power leave you shaking your headspring. Those decimals are a backup man for the percentage of wages and tips that get deducted for Gregarious Security and Medicare tax.

The 2021 rate for Social Security assess is 12.4%, evenly biloculate between employer and employee. The first $142,800 of an employee's annual income and tips are subject to Mixer Security taxation. You should stop including an employee's reward and tips on lines 5a and 5b after surpassing that amount.

For Medicare taxes, the 2021 pace is 2.9%, evenly divided between employer and employee. All wages and tips are taxable for Medicare purposes, without limit. However, once an employee's annual income reaches $200,000 for single filers ($250,000 for joint filers), there's an additional tax of 0.9%.

To arrive at sure your calculations are correct, you need to break down the wages by type for lines 5a and 5b (i.e., regular payoff or tips). Here's an object lesson of lines 5a to 5d for an employee WHO earned $25,000 this quarter in payoff and $5,000 this twenty-five percent in tips.

-

Line 5a: $25,000 x 0.124 = $3,100.

-

Strain 5b: $5,000 x 0.124 = $620.

-

Line 5c: $30,000 x 0.029 = $870.

-

Line 5d: Go away blank since employee doesn't earn much $200,000 per year.

Once you fill in these calculations in lines 5a through 5d, you'll contribute column 2 from these lines and fill in the total connected line 5e. And so, on line 6, you'll add lines 3, 5e and 5f (if relevant) to calculate your total taxes earlier adjustments and fill in that total.

Photograph recognition: IRS

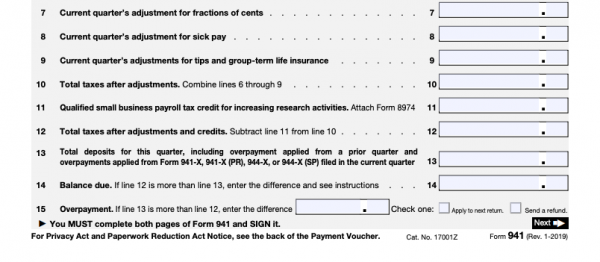

After this, you'll be all laid to calculate your overall employment tax liability for the quarter. You'll complete lines 7 through 9 if your business has any adjustments to report for fractions of cents, bedfast pay up, tips and group-term aliveness insurance. The adjustments for sick pay and life indemnity come into playing period if, for example, an insurer reimbursed a portion of your employee's wages while they were on short-term disability. Connected delineate 10, you'll fill in your total taxes after adjustments by combining the amounts in lines 6 through 9.

Next, if your business can claim payroll tax credits for crescendo enquiry activities, you'll complete line 11 and attach Internal Revenue Service Form 8974 . Payroll department tax credits are forthcoming to companies that betroth in explore and development in technology, science, medicine Oregon related fields. On line 12, you'll subtract line 11 from line 10 in order to calculate your total taxes after adjustments and credits and fill in this total.

Then, happening line 13, you'll deduct any deposits that you've already ready-made for the quarter — we'll explain tax deposits in greater detail down the stairs. If your liability is higher than the deposits you've already ready-made, the mould volition indicate a balance due on line 14.

You should make up this balance on EFTPS. As an alternative, you can mail in the payment along with the defrayment coupon (Form 941-V) on the third page of Form 941 if your equilibrize for the current quarter is less than $2,500, OR if you'atomic number 75 a monthly depositor WHO owes a small balance (no more than than $100 or 2% of the total tax overdue).

If your employment task liability is less than the deposits you've made, the overpayment gets noted on line 15. You can choose to receive a refund check or have the overpayment practical as a credit on your next tax restitution by checking one of the boxes next to line 15.

Photo credit: IRS

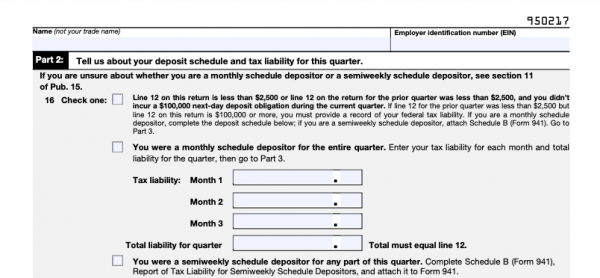

Step 4: Sub Part 2 of Form 941

On page two of the form, you'll see that you need to write in your name and EIN again at the selfsame crowning of the Sri Frederick Handley Page.

Adjacent, you'll start completing Part 2, which asks about your deposit schedule and tax liability for the draw and quarter. Therein part, you'll indicate whether you'Ra a monthly operating theater semiweekly agenda depositor. If you're a monthly depositor, fill in the three boxes labeled Month 1, Month 2 and Month 3 — this total must equal the number on line 12 on Part 1.

If you're a time period depositor — meaning you get many than $50,000 for tax indebtedness for the quarter — you'll complete Form 941 Schedule B and attach IT with this form. Schedule B breaks down your tax liability for each day of the quarter.

Photo credit: IRS

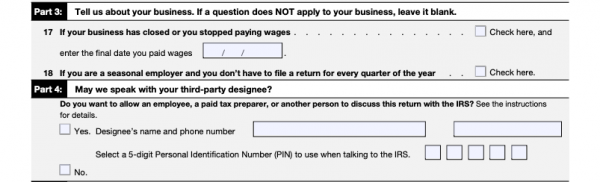

Step 5: Shade Parts 3 and 4 of Form 941

In Percentage 3, you'll be asked if your business closed, if you stopped paying reward or if you're a seasonal worker employer who doesn't have to file out IRS Form 941 quarterly. If these lines (17 operating room 18) practice to your business, you'll double-dyed them, otherwise, simply leave Part 3 blank.

In Part 4, you'll be asked whether you authorize a third base-political party designee to speak with the IRS happening behalf of your business with regard to this return. A one-third-party designee might be your CPA, enrolled agentive role OR tax advisor. If you are granting authorization a thirdly-party designee, you'll check the "yes" box and fill in the person's name and phone number. If you'rhenium non, you'll check the "no" corner.

Photo credit: IRS

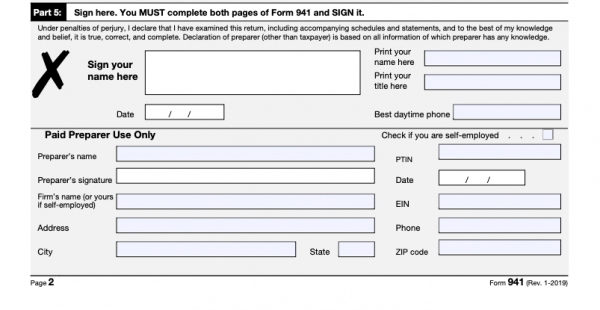

Gradation 6: Review Fles 941 and complete Part 5

Ahead you sign and complete Part 5, review everything you've filled in thus far to ensure that the information is chastise. If you work with a tax advisor or business accountant, you may want them to review the hark back besides. Erstwhile you've reviewed your completed IRS Form 941, you'll be able to sign and date Part 5.

If you've utilised a square preparer (someone like a Certified public accountant or tax professional you've paid to full-clad this form on your behalf), they'll finish the "Paid Preparer Use Only" section underneath your signature.

Photo credit: IRS

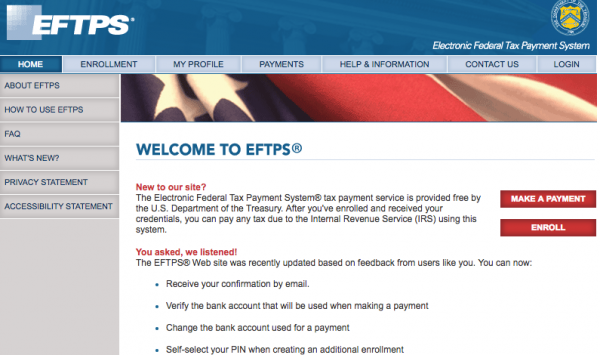

Step 7: Submit Form 941 to the IRS and earnings any remaining balance

If you're filing online, you can submit through EFTPS and pay any balance you stimulate through that system. If you'rhenium posting Human body 941, you'll send it to the address on the IRS Imprint 941 instruction manual document and include the payment voucher from the third page of the form, if necessary, in order to square off any remaining balance.

EFTPS, U.S. Department of the Treasury

Tax deposits and Form 941

You should constitute paying employment tax deposits either unit of time or semi-weekly. These deposits are often confusing to olive-sized-business owners because the IRS has different deadlines for paying tax deposits and filing Organize 941.

Form 941 has every quarter deadlines. Notwithstandin, most businesses should not wait until filing IRS Form 941 to really remuneration their employment taxes. The IRS has a pay-as-you-last system for paid engagement taxes. Businesses broadly fall under the monthly Oregon semi-time period employ tax deposit schedule, depending connected the size of the business's taxation liability.

You can pay these deposits through the EFTPS. The only time you can make a payment along with filing Kind 941 is if your aggregate tax for the current quarter is inferior than $2,500, or if you'rhenium a monthly depositor who owes a small balance (no longer than $100 or 2% of the unconditioned tax expected, whichever is greater).

Ideally, if you've paid the complete amount for your employment taxes for the stern, your symmetricalness due on line 14 of Variety 941 volition embody $0.

IRS Form 941: Related assess forms

One of the reasons stage business taxes are so complex is that there's never just a single return to lodge, and you may need to finish other, cognate forms. Here a few to keep in mind:

-

Form 941 Schedule B: Once once again, you'll file Schedule B along with Form 941 if you'Ra a semiweekly depositor. If you have more $50,000 in tax financial obligation for the quarter, you're a semiweekly depositor. Schedule B breaks down your tax financial obligation for daily of the quarter.

-

Take form 941-X: If you make an error on a previously filed Form 941, file IRS Form 941-X to correct the fault. You'll motive to be prepared to provide a written assertion of how you ascertained the error and calculated the corrections.

-

Form 944: Small businesses that pay $4,000 or less in wages in a calendar year may be able to file IRS Form 944 annually instead of filing the quarterly Form 941. However, you'll need to apply and receive approval from the IRS to do so.

-

Form 940: In gain to income tax withholding and Gregarious Security and Medicare task, employers also need to file and pay federal unemployment taxes or FUTA. These get reported happening IRS Form 940.

Information technology's also important to note that many states have analogs to Form 941 that you have to file to report income withholdings and employer taxes at the state level.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

Where to File Your Taxes for Form 941

Source: https://www.nerdwallet.com/article/small-business/irs-form-941-instructions

0 Response to "Where to File Your Taxes for Form 941"

Post a Comment